Renters Insurance in and around Sherman

Looking for renters insurance in Sherman?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

No matter what you're considering as you rent a home - utilities, size, location, condo or apartment - getting the right insurance can be vital in the event of the unpredictable.

Looking for renters insurance in Sherman?

Coverage for what's yours, in your rented home

There's No Place Like Home

When the unanticipated burglary happens to your rented apartment or space, often it affects your personal belongings, such as sports equipment, an entertainment system or a set of favorite books. That's where your renters insurance comes in. State Farm agent Nat McClure is committed to helping you examine your needs so that you can protect your belongings.

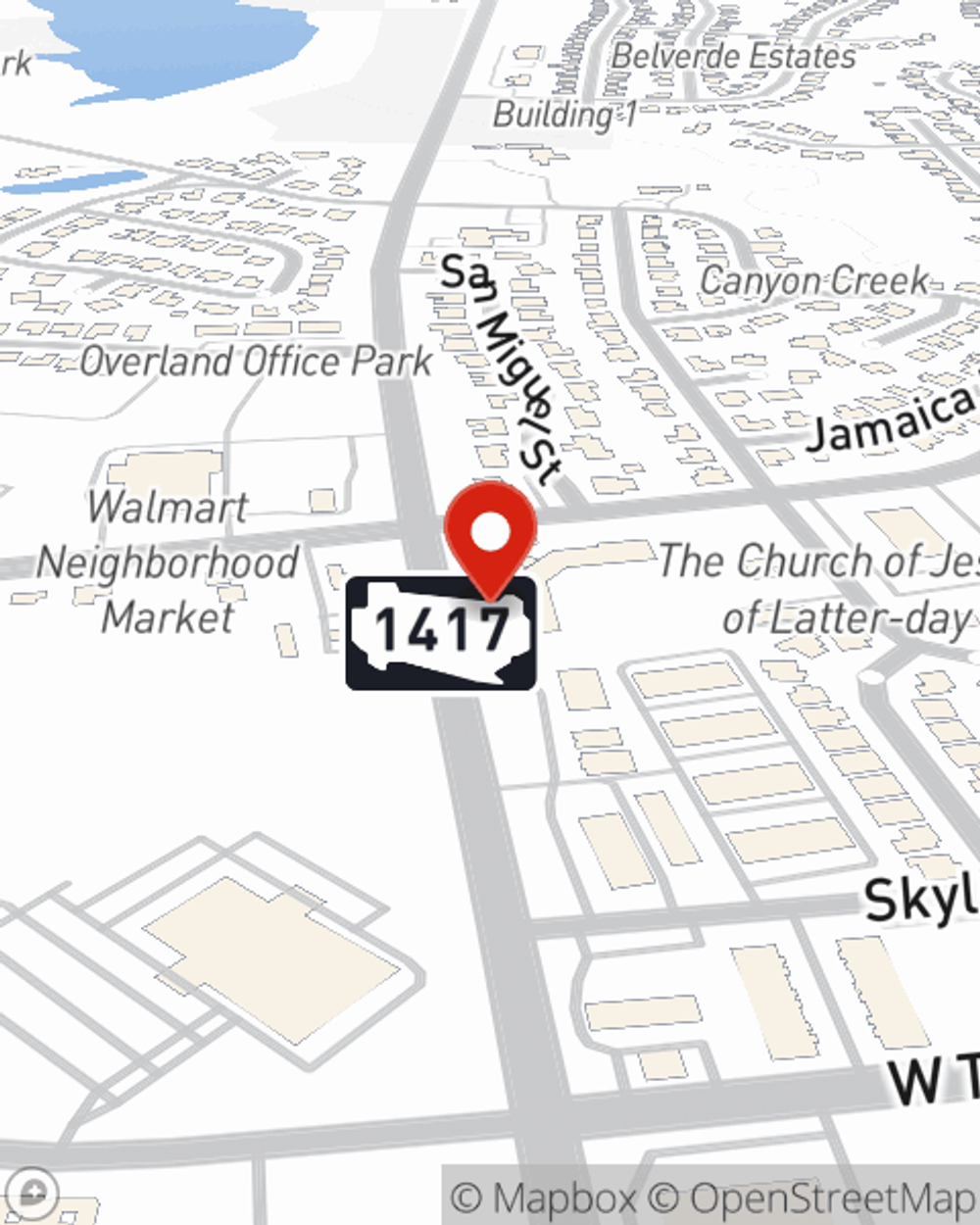

It's always a good idea to be prepared. Reach out to State Farm agent Nat McClure for help learning more about coverage options for your rented space.

Have More Questions About Renters Insurance?

Call Nat at (903) 893-9621 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.

Nat McClure

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to file a renters insurance claim

How to file a renters insurance claim

Learn how to file a renters insurance claim and understand your renters insurance coverage.